Santander / Abbey: integration strategy

In order to transform Abbey into one of the most profitable and efficient banks in the UK banking system, Santander proposed to build up Abbey's business on its existing foundations, to which the Group will contribute its own strengths, particularly its business model and technology.

A) Integration of Human Resources

i. People Retention

Santander’s focus on efficiency and its eagerness to achieve the cost synergies promised to investors entailed a consistent reduction of Abbey workforce. Around 4,000 jobs were cut after the deal was closed. More layoffs are likely to follow. As a matter of fact, in October 2005 Santander disclosed that it is planning further lay-offs without mentioning the exact amount of job cuts. Analysts estimate a total reduction of 6,500 employees which would mean an overall personnel reduction of a quarter of the Abbey staff at the moment of the acquisition.

The areas most affected by job losses were those with most redundancies and in which Santander already had an enormous strength, thus allowing Abbey to profit from economies of scale. These areas were for example marketing – advertising, brand management, communications and press – and information technology. The selection of candidates for redundancy was most times carried out by existing Abbey top managers rather than executives from Abbey new Spanish master.

ii. Redefinition of roles and customer orientation

Santander’s human resources strategy has not only focused on reducing Abbey workforce, but it also encompassed a redefinition of jobs aimed at aligning Abbey customer service with Santander’s standards of excellence.

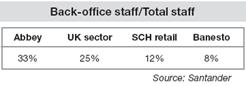

Customer  service is a main pillar of Santander’s business model. To improve Abbey’s poor service levels has become a major objective. The Spanish bank wanted to do so by moving employees from back- office to front-office activities thus reducing the excessive percentage of back-office staff relative to total personnel, whose ratio at the moment of the acquisition was significantly higher than the UK average and other bank’s in the Santander group.

service is a main pillar of Santander’s business model. To improve Abbey’s poor service levels has become a major objective. The Spanish bank wanted to do so by moving employees from back- office to front-office activities thus reducing the excessive percentage of back-office staff relative to total personnel, whose ratio at the moment of the acquisition was significantly higher than the UK average and other bank’s in the Santander group.

In order to deliver more value to customers, Santander has set up an extensive training program to support staff and equip employees with the skills required to comply with their new front-desk roles. As a result 30% more of Abbey's staff will be authorized to sell financial products. At the same time, ambitious productivity targets have been set, with a reduction in average time spent advising on a mortgage from 2.5 hours to 1.5.

iii. Leadership

Francisco Gómez Roldán, an experienced CEO at different Spanish banks such as Banesto, Banco Español de Crédito and Argentaria was appointed as new Abbey CEO on October 21, 2004 to personally champion and leverage Santander’s business model at Abbey. The appointment of a Spanish CEO to lead a British bank signalled a departure from Santander’s tradition to name leaders from the local pool of executives to take advantage of their knowledge of the local market.

His appointment fitted well into Santander’s integration strategy of quickly restructuring Abbey retail business and improving its financial performance. It also reflected Santander’s confidence in the transferability of its core competences in retailing to a different context which lies at the basis of Santander’s geographic diversification strategy.

Gómez Roldán was probably also the ideal candidate to address the integration strategy. He had already gone through similar situations at Spanish banks Argentaria and Banesto where he was asked to improve market share and revive the business. In those cases the development of IT platforms was particularly helpful in mortgages, which is also Abbey’s main business. Nevertheless Abbey acquisition presented a further challenge: managing the Latino and the British culture by extracting the greatest value from the combination of the two. Cultural sensitiveness of Spanish management is fundamental to strike a balance between the two business models and cultures and to gain Abbey staff support in the integration strategy implementation.

An additional significant appointment was that of Graeme Hardie as a board-level sales and marketing director. He was also crucial to foster a cultural change. Despite coming from RBS he was aligned with Santander’s style: “I knew Santander's approach to business and it was very similar to RBS's – fast moving and quick at decision making.”-he said. Given his previous experience in the UK market he also brought to Spanish management the knowledge of local context that it lacked.

B) Process Integration: Installation of the Group’s technology platform

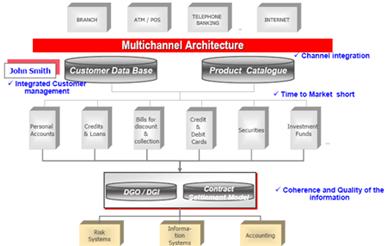

Obtaining  cost savings from the implementation of Santander’s IT Systems will be a key to the success of the merger. The expected value creation from the implementation of Partenon IT platform accounts for one third of total cost savings or EUR 150 million from 2007 onwards. Partenon is an in-house IT platform developed by BSCH to streamline and cut costs following several acquisitions by the bank in Spain. The Group’s banks that have already implemented it have achieved significant cost reductions, since it has replaced their traditional silo based IT-Systems. Traditionally silo based IT-systems were structurally inefficient: they had a redundancy of structures for different activities, lacked a single customer view and resulted in an increasing cost of IT and operations. The Partenon system enabled the integration of different activities and channels, a higher coherence and information quality and a shorter time to market. It is a structural competitive advantage for Santander, since it is a more advanced system than other banks’.

cost savings from the implementation of Santander’s IT Systems will be a key to the success of the merger. The expected value creation from the implementation of Partenon IT platform accounts for one third of total cost savings or EUR 150 million from 2007 onwards. Partenon is an in-house IT platform developed by BSCH to streamline and cut costs following several acquisitions by the bank in Spain. The Group’s banks that have already implemented it have achieved significant cost reductions, since it has replaced their traditional silo based IT-Systems. Traditionally silo based IT-systems were structurally inefficient: they had a redundancy of structures for different activities, lacked a single customer view and resulted in an increasing cost of IT and operations. The Partenon system enabled the integration of different activities and channels, a higher coherence and information quality and a shorter time to market. It is a structural competitive advantage for Santander, since it is a more advanced system than other banks’.

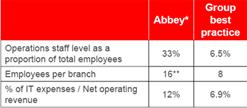

The following BSCH chart shows how BSCH expects Partenon to improve Abbey’s efficiency in back-office and IT spending and also its productivity in front-office activities.  The installation of Partenon is expected to be concluded in 2007. The implementation of Partenon at Abbey will result in significant cost savings. Abbey had multiple legacy platforms following the acquisition of its insurance companies, Scottish Mutual and Scottish Provident. The implementation of the new platform will allow Abbey to share IT costs with other BSCH units: IT projects at Abbey which are already covered by Partenon will be cut. Implementing a single client database and introducing electronic products will also lead to higher cross-selling of products. Parthenon allows the disparate parts of the Santander group to share each other's product expertise. If Abbey, for example, wants to launch a new product it can see if it is in the products catalogue shared with BSCH, Banesto and Totta. This saves time and investment.

The installation of Partenon is expected to be concluded in 2007. The implementation of Partenon at Abbey will result in significant cost savings. Abbey had multiple legacy platforms following the acquisition of its insurance companies, Scottish Mutual and Scottish Provident. The implementation of the new platform will allow Abbey to share IT costs with other BSCH units: IT projects at Abbey which are already covered by Partenon will be cut. Implementing a single client database and introducing electronic products will also lead to higher cross-selling of products. Parthenon allows the disparate parts of the Santander group to share each other's product expertise. If Abbey, for example, wants to launch a new product it can see if it is in the products catalogue shared with BSCH, Banesto and Totta. This saves time and investment.

C) Brand

Santander’s visual identity consists of the flame and the word Santander as a frame for the logo of the specific unit where it is displayed. The strategic positioning of the brand is summarized by the slogan: “The value of ideas”.

Santander sees its brand as a strategic asset that creates value. In April 2004, its Board approved the project Identity 2007, a set of rules regarding the management of corporate identity, applicable in all countries, units and divisions of the bank. These rules establish a common code for the entire Group, fostering internally a sense of belonging and conveying externally recognition, confidence and credibility.

Abbey was integrated into this strategy and started a £8m branch refurbishment program in May 2005 to change its logo. Abbey’s new logo consists of the white Santander flame and the word “Abbey” on a red background. This m ove fits into Santander’s strategy to create a common identity in all its units and countries and is a further step towards Santander’s objective of becoming and being recognized as a global bank. Furthermore, the Santander “flame” symbol shows customers that Abbey has the support of a powerful global financial services group behind it.

ove fits into Santander’s strategy to create a common identity in all its units and countries and is a further step towards Santander’s objective of becoming and being recognized as a global bank. Furthermore, the Santander “flame” symbol shows customers that Abbey has the support of a powerful global financial services group behind it.

Nevertheless, we have to take into account that this rebranding only took place 17 months after another rebranding occurred before the acquisition which was called by experts “one of the biggest rebranding disasters in corporate history” . A further change may cause confusion among the customers and has to be followed, in any case, by a change in management. Derek Mabbott, senior manager at London-based branding specialist Prophet said about the new strategy: "The last rebrand of Abbey has become a classic example of how not to do re-branding. Pastel shades and quirky ads do not sell financial services, or anything else for that matter. With its current rebrand, Santander is trying to draw a line under the events of the last few years. It is seeking to give itself and Abbey customers a fresh start. The new logo is simply a sign saying 'under new management'. What really matters is what that new management delivers for customers, not the sign over the door."

in any case, by a change in management. Derek Mabbott, senior manager at London-based branding specialist Prophet said about the new strategy: "The last rebrand of Abbey has become a classic example of how not to do re-branding. Pastel shades and quirky ads do not sell financial services, or anything else for that matter. With its current rebrand, Santander is trying to draw a line under the events of the last few years. It is seeking to give itself and Abbey customers a fresh start. The new logo is simply a sign saying 'under new management'. What really matters is what that new management delivers for customers, not the sign over the door."

:: The Santander / Abbey deal :: I. Background: History | Santander | Abbey | reactions; II. Acquisition objectives | synergies | complexities; III. Integration strategy | assessment; IV. The deal: evaluation | bibliography | index |

“ Spain: Santander 11 November 2004 Earning revision” Cheuvreux analyst report.

“Getting back to the Abbey habit”, Clive Horwood, www.euromoney.com, July 2005.

Gómez Roldán played an important role in the merger of BBV and Argentaria which led to the creation of BBVA. In 2000 he became CEO of Banesto, a Spanish bank acquired by Santander in 1994.

“Shareholder’s Annual Review 2004”, Grupo Santander.

“Getting back to the Abbey habit”, Clive Horwood, www.euromoney.com, July 2005.

“The Tricky Art of Corporate Makeover: Abbey Gives Rebranding Another Go” - Sunday Herald, March 6, 2005.

Literatura

Literatura

Compatibilidad

Compatibilidad