Santander / Abbey: evaluation

i. The deal

The Abbey deal showed that barriers to cross-border banking in Europe were not insurmountable. It was farsighted in initiating a process that gives Santander a first-mover advantage with respect to its Spanish competitors in terms of size, reach and potential for further growth. The soundness of Santander business model and strategy made it also win the Banker and the Euromoney 2005 awards.

From a corporate strategy perspective Santander’s main objectives of increased market share and diversification were appropriate given the characteristics of the European banking sector and the saturation of the domestic market in terms potential for further growth by consolidation. Despite the inherent challenges, the corporate development strategy pursued matched those objectives.

Abbey acquisition had actually a good potential because it allowed Santander to immediately enter the British banking sector, therefore increasing its market share, customer base as well as product offerings by integrating Abbey complementary businesses. The deal made sense because Abbey had good quality assets (brand and customer base), but its franchise was underperforming despite the fact that Abbey had undergone a restructuring phase before being acquired. This opened an opportunity for Santander to create value since it had a clear retail business model to export, IT systems to leverage and spare management capacity to execute the integration. Santander’s capabilities enabled it to accelerate the turnaround at Abbey laying the basis for growth and increased competitiveness with respect to the other main UK banks.

The success of Santander acquisition strategy is also due to its internal development through investment in technological edge and innovation and through management focus on costs. The competences that are so created represent strategic assets to leverage in acquisitions; they reinforce the Group financial strength and enhance its ability to deal with integrations.

Furthermore Santander properly managed the pre-closure phase securing regulatory approval within weeks so that it took just over 100 days from announcing the agreed offer to completing it. As a result Santander minimized the uncertainty in that critical phase that might have impaired the subsequent integration process. Santander clear vision and planning of the integration execution helped to give sense of direction to the Group.

ii. The integration

The integration strategy, which entails a deep turnaround at Abbey, is aligned with the deal objective of establishing a strong presence in the British market by improving Abbey performance.

The first phase of the integration strategy targeted improvements in customer retention by establishing a new sales culture and in operating efficiency through the transfer of best practices. The second stage plans to achieve IT economies of scale in order to create value and boost sales. According to Abbey CEO results have been achieved also in terms of effective rebranding of Abbey, reduction of level of turnover and absenteeism and raising sales capacity. The rebranding decision was appropriate since it facilitated external and internal communication signaling Abbey new image and customer service strategy..

Santander’s integration approach was also in great part responsive to the challenges that it faced. The restructuring process was meant to stabilize and grow Abbey markets share in face of stiff domestic competition; at the same time, expanding Abbey business to new areas opened the opportunity for cross selling and made Abbey less dependent on the profitability of the mortgage business.

Given that this deal involved the acquisition of retail banking, personnel reduction was considered a source of cost synergies, the opposite than in case of an acquisition of an investment bank where retention of personnel capabilities and tacit knowledge is a crucial issue. Even if the context is different, cost reduction targets have to be balanced against the necessity to ensure adequate employees’ morale. As a matter of fact Santander’s choices in terms of layoffs might impair Santander’s ability to buy-in Abbey’s staff support to deal with the organizational complexity of executing integration across the border. The Abbey National Group Union expressed concern as further job cuts were announced, stressing the trauma already undergone by Abbey employees which witnessed the layoff of 4000 of their colleagues.

The choice of a Spanish CEO and management was mandated by the urgency to foster changes at Abbey and by the fact that in order to transfer best practices it is necessary to transfer people who embed them. A possible drawback of this choice can be the amplified resistance of personnel to changes, when these are imposed by a management belonging to a different culture.

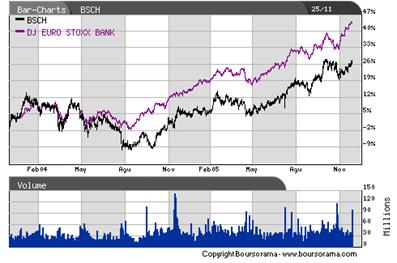

iii. Stock Price performance

Banco  Santander Central Hispano has clearly underperformed its index of reference since the Abbey transaction was announced. Indeed, from the time rumours emerged in May 2004, Santander has done worse than the DJ Euro Stoxx Bank Index by approximately 15% over a year and a half, which is equivalent to a market cap undervaluation of around €9bn, if BSCH had kept up with the index just as it did in the past month before the Abbey deal. Relative to BBVA, Santander’s major competitor, the loss amounts at €13bn in market capitalization.

Santander Central Hispano has clearly underperformed its index of reference since the Abbey transaction was announced. Indeed, from the time rumours emerged in May 2004, Santander has done worse than the DJ Euro Stoxx Bank Index by approximately 15% over a year and a half, which is equivalent to a market cap undervaluation of around €9bn, if BSCH had kept up with the index just as it did in the past month before the Abbey deal. Relative to BBVA, Santander’s major competitor, the loss amounts at €13bn in market capitalization.

Indeed, a factor than undermined the stock performance is the dilutive effect of the acquisition of Abbey National as the net profit contribution leads to a Return on Investment that is seen to remain below the cost of capital until 2008. Santander’s stock price took a big hit initially as the market thought that Santander paid more than full price for Abbey and did not see much potential for value creation by going ahead with the deal. Then, BSCH did not catch up with the index as it seems that there are still some areas where investors remain sceptical, such as the revenue synergies, the possible impact of a deterioration of the UK housing cycle, the tough competitive environment Abbey will face and the level of deterioration of the Abbey franchise during the takeover process.

iv. Financial performance

Nevertheless in terms of financial performance, the Q3 2005 results came in line with the company’s estimates confirming that mortgage new growth momentum was sustainable, that margins in mortgages are stabilizing, commissions are strong again due to changes in prices (and some volumes). Abbey continues to focus on deposits and is succeeding in getting new volumes. Overall, earnings report are now showing how the business momentum is beginning to come through and how the BSCH management has succeeded in stabilizing revenues in 2005. Thus, Santander will likely achieve its target of €125 million net profit for Abbey National in 2007.

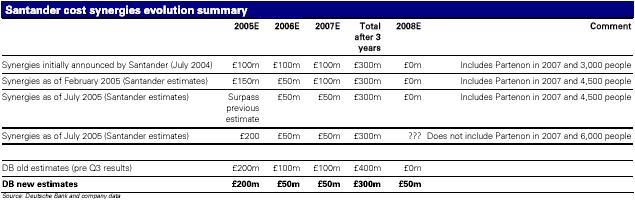

Furthermore, Santander’s management has delivered all the promised cost synergies. In fact, the back office costs have been reduced even faster than planned. Thus, the Abbey turnaround seems to be coming along.

Still, the overdelivery of cost savings was offset against future synergies, leading to the same initially announced £300m total (€450 million). The successful execution of all cost savings measures during 2005 led to £200 million (€300 million) in cost savings already the first year but it is also due to a reduction of 4000 employees in 2005 vs. the initial plan of 3000 employees in 3 years.

It appears that, by keeping the cost saving target unchanged, Abbey will compensate the better back office underlying costs with investments in commercial effort for revenue growth. This might be the right strategy, as revenue momentum will drive earnings growth and profitability in the medium term.

:: The Santander / Abbey deal :: I. Background: History | Santander | Abbey | reactions; II. Acquisition objectives | synergies | complexities; III. Integration strategy | assessment; IV. The deal: evaluation | bibliography | index |

Literatura

Literatura

Compatibilidad

Compatibilidad